Back to all work

BroadWalk

Designing Intuitive Corporate Intelligence Solutions. Transforming Data into Actionable Investment Insights

Industry

Business Intelligence

Timeline

2024

Platform

Website

Scope

UX Research, UX Design, UI Design

About

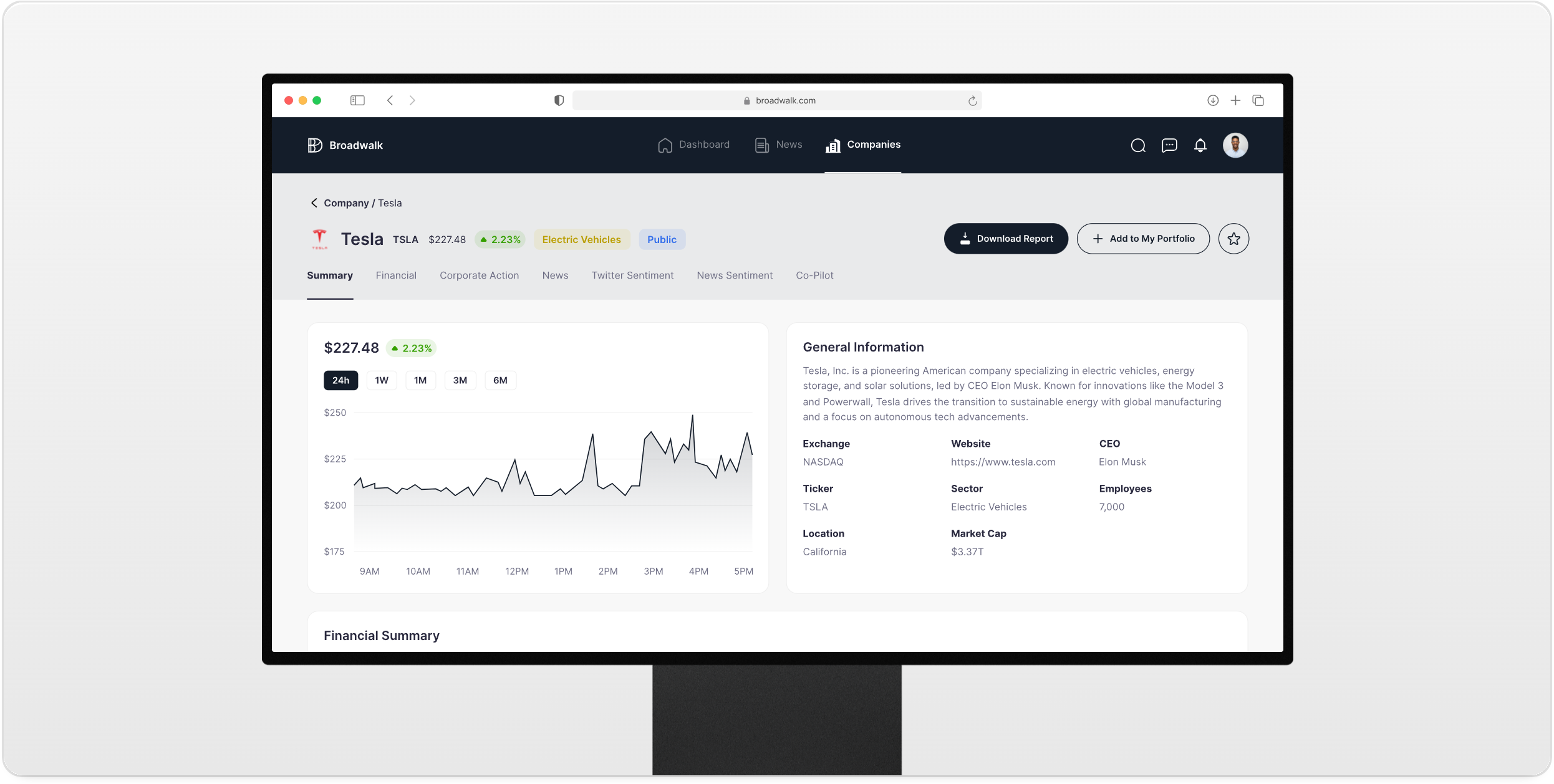

Broadwalk is a comprehensive platform that aggregates financial and alternative data to provide investors with actionable intelligence.

We focus on delivering deep qualitative analysis and early warning signals, helping investment professionals make informed decisions through AI-powered insights and sentiment analysis. Our platform bridges the gap between abundant data and meaningful insights in the investment landscape.

Background

Investment research challenges need for integrated intelligence solutions

The investment industry has traditionally relied on fragmented data sources, manual processes, and relationship-based research methods. Investment professionals have access to millions of potential companies but struggle with maintaining target lists and workflows. Multiple systems and complex integrations have created a landscape where there's abundant data but limited meaningful insights.

Challenge

Converting data overload into strategic intelligence streamlining investment decision-making

Investment professionals face the challenge of processing vast amounts of unstructured data while maintaining high-quality analysis. They need to identify growth drivers and potential risks early, track company traction effectively, and gather reliable financial data points. The industry requires a solution that can process alternative data sources and provide early warnings about emerging trends.

Strategy

Deep Qualitative Analysis

Instead of multiplying data points, we focus on in-depth qualitative analysis. Our approach concentrates on answering key questions about company traction and business risks, providing thorough insights rather than surface-level data.

Alternative Data Integration

We capture and analyze data from multiple sources including social media, news, employee reviews, and customer feedback. This comprehensive approach helps measure company traction, engagement, and adoption through online activity metrics.

Risk Assessment Framework

Our platform identifies and categorizes emerging risks through sophisticated sentiment analysis. We monitor various risk categories and measure reasons for negative sentiment, providing early warning signals for potential issues.

Financial Intelligence

We leverage SEC regulatory reporting to capture financial data from private companies. Our system spots trends in industry fundraising and gathers growth data points, providing crucial insights into revenue trends and market dynamics.